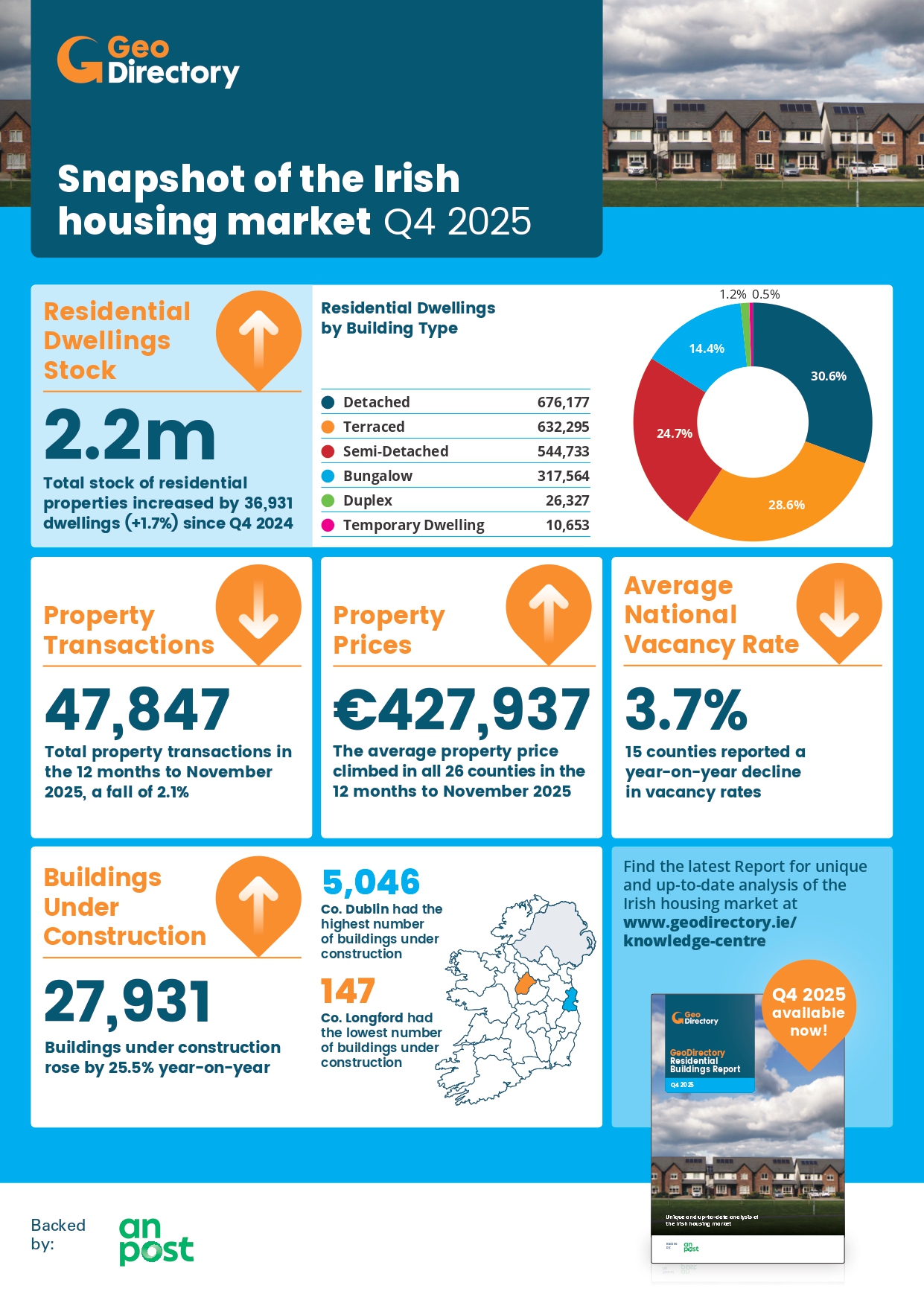

[Infographic] Snapshot of the Irish housing market Q4 2025

The newly released GeoDirectory Residential Buildings Report Q4 2025 provides a data‑driven snapshot of Ireland’s housing landscape. Built on the most comprehensive database of residential addresses in the country, this edition uncovers critical trends in housing stock, vacancy, construction activity and transactions.

Property Prices Continue to Rise Nationwide

Average residential property prices reached €427,937, with all 26 counties recording year‑on‑year price increases.For businesses operating in mortgage lending, property development, insurance, and location intelligence, this consistent upward movement underscores the sustained demand and the need for precise, up‑to‑date market data to guide risk models and strategic planning.

Housing Stock Expands, Driven by New Builds

Ireland’s total residential stock rose to 2.2 million dwellings, an annual increase of 36,931 properties (+1.7%) since Q4 2024.Breakdown by building type highlights the diversity of Ireland’s housing landscape:

- Detached: 676,177

- Terraced: 632,295

- Semi‑Detached: 544,733

- Bungalow: 317,564

- Duplex: 26,327

- Temporary Dwelling: 10,653

Vacancy Rates Continue to Decline

The national average vacancy rate now stands at 3.7%, with 15 counties reporting a year‑on‑year drop in vacant dwellings. Understanding where vacancy is tightening provides critical context for:

- Property investment strategies

- Public sector housing initiatives

- Retail and service‑sector location planning

- Demand forecasting for local markets

Property Transactions Experience a Slight Decline

Property market activity saw a modest slowdown, with 47,847 transactions recorded in the 12 months to November 2025 — a decrease of 2.1% year‑on‑year. For lenders, estate agents and market analysts, this shift offers valuable insight into buyer behaviour, interest‑rate impacts and regional activity patterns.

Construction Activity Surges

One of the standout findings: buildings under construction increased by 25.5%, rising to 27,931 nationwide.- Co. Dublin leads with 5,046 buildings under construction

- Co. Longford reported the lowest level, with 147 new builds underway

Access the Full Q4 2025 Report

To explore deeper county‑level insights, long‑term trends and market analysis, download the full report by completing the form below.Posted: 29/01/2026 09:00:12