Introduction

This is my second and last blog on the easy to remember and catchy titled ‘Special Eurobarometer 487a’ whatever you do don’t forget the ‘a’ after ‘487’. But never mind, the data is excellent.

Social Network

The five key determinants to the level of social network activity are:

• Age

• Education

• Household size

• Daily use of the internet

• Level of internet shopping

Some are not surprising for example age with 96% of all 15-24 year olds using social networks and only 55% of the 55+ demographic using social networks. I know what your thinking is......... the 15-24 bracket are insecure, narcissistic and only see success and self-worth through external validation via ‘likes’ and ‘followers’. Maybe it’s because they have no responsibility and have the time to do what they want? Or both.

Usage Rates

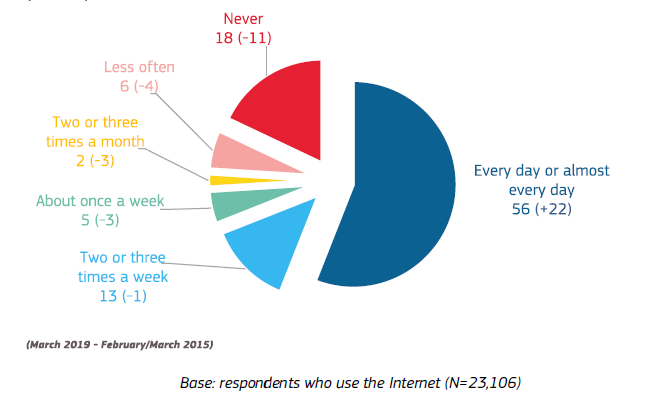

Just over 8 out of 10 (82%) of who use the internet has a social network account. 76% use it two to three times a month and 56% use their network account on a daily bases.

There has been a significant jump in both the proportion using social networks (15%) and in daily use of their accounts (22%).

Nor is it that unexpected that those with the highest daily usage rates are the heaviest users of social networks. Mind you the degree of difference is noticeable with 80% of daily users on social networks versus only 41% of non-daily users. These non-daily users really need to get a digital life.

Figure 1 Use of social networks

The three odd, well really two but I prefer things in threes, that caught my attention were education, household size and level of internet shopping.

I am not surprised by internet shopping being a driver as it makes sense that social networks ads would drive shopping and that shoppers would look for social network re-action before buying. Basically social network and online buying feed each other. 87% of those who regularly purchase online are social network users, 77% for less frequent users and 57% who never buy online.

I was though, surprised to see that both education and household size were so positively aligned with the use of social networks. If you stayed in education until 16 or over and/or are living in a household of three or more you are much more likely to be a social network user.

What is also true is that there is a slight preference for women to use social networks over men with the figures showing 78% women are on social networks with men not that far behind (but always behind I hear you say) at 74%.

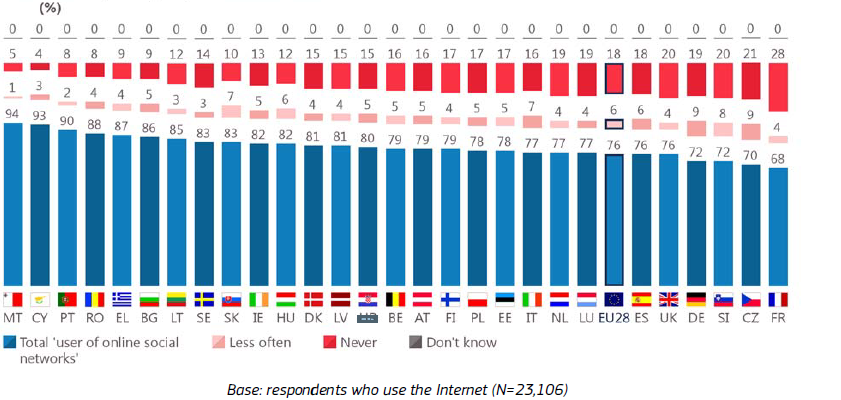

Although, while social networks seem all pervasive nearly 1 in 5 people don’t use them and that grows to nearly 1 in 3 in France. The question I bet you are asking yourself is - are these the type of people we would want to meet online or elsewhere? It will be interesting though to watch this number as privacy issues continue to break about our use of social networks.

The highest penetration of social network use is in Malta at 93% and the lowest is in France at 68%

Figure 2 Social Network usage by country

However, in many countries there has been considerable growth since 2015 with the largest increases in Cyprus +34%, Malta +33%, Denmark +26% and Ireland, Austria and Poland with +25% growth.

As you can see from the graph Ireland has 87% of the internet audience on a social network with 82% being regularly users and 5% less often. There is 13% of internet users who don’t use any social network. However, this is down by 10% since 2015 and the less often is down by 1%. Basically social networks are well used and the growth trend is very much upwards.

Purchase of Goods and Services on Line

Key determinants of online purchase

Based on this research there are seven key determinants to the level of on line purchase

1) Age – 15-39 more than eight people out of ten in these age brackets have bought online

2) Education – the more educated the more likely you are to buy online with over 85% of those who stayed in education until 20 or over buying online

3) Households – those households with 3 or more people likely to buy online

4) Financial Position – the stronger your financial position the more likely you are to buy online

5) Daily use –If you are a daily user of the internet you are almost twice as likely to buy online as a non-daily user

6) Profession – A big influence with Managers (92%) being the highest, student, white-collar workers and self-employed not far behind on circa 85%

7) Class – Upper middle class are 91% are the most likely to purchase online and only 68% for working class

Before reading this report I expected to see a large growth in online purchases. And the initial figure of 77% of internet user buying goods and services online backed this impression. However, it turns out that the percentage of regular purchases online has remained at 39% since 2015. This is good news for both brick and mortar retailers and for online sellers as it provides both with an opportunity to maintain and grow businesses.

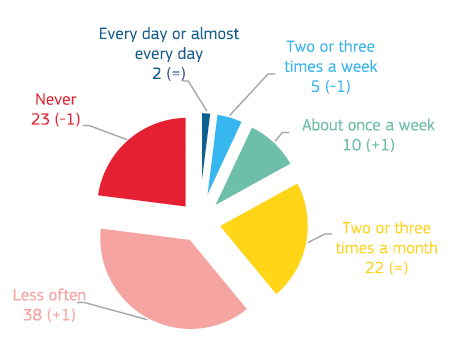

As figure 3 below shows almost 1 in 4 people never buy online, only 2% do so daily, 5% do so a couple of times a week and 10% once a week.

Figure 3 Frequency of on line purchase

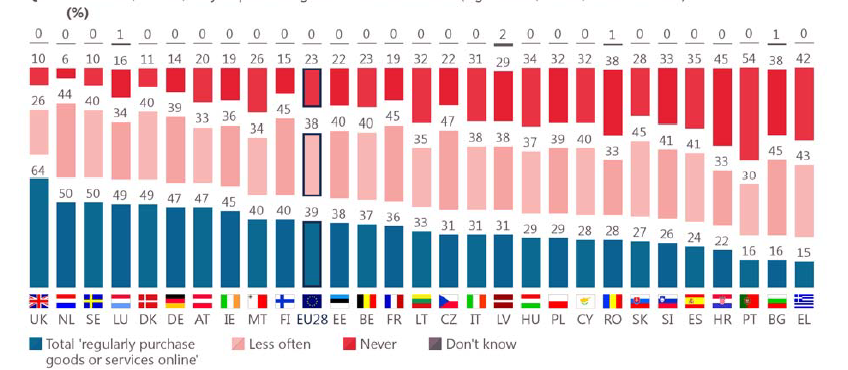

There are of course wide differences across countries. In the UK (64%), Netherlands and Sweden (50%) regularly buy online and the lowest is Greece where it is just 15% ( see figure 4 below )

The trend however, seems to be moving towards greater online purchases with 15 countries buying more online than they did in 2015. Luxembourg is showing the biggest increase at 10%.

On the other side of the coin Poland has seen a decrease of 12% and Hungary 6%. To counter balance these figures there has been a drop in the number of people who never buy online by 10% in Romania and by 6% in Spain and the Netherlands.

Figure 4 Frequency of on line purchase by country

From an Irish point of view we can see from figure 4 that 81% of people in Ireland who are online are buying online. With 45% regularly purchases and 36% less often. There is still 19% or nearly 1 in 5 users who have online access that do not buy online.

And the Irish trend, based on this survey, is that less people from Ireland are buying online as measured versus 2015. With regularly purchases down 4%, less often down 1% and never purchase up 5% compared to 2015.

Summary

The growth in use of social networks continues at a pace however, online shopping has a more gently growth curve. They key determinates to the growth shared by both are

Age – 15-39 key group

Household size – three or more key group

Education – 20 plus when leaving education key group

Daily use of the internet.

This blog is second in a two part series based on the Eurobarometer 487a report link below to first blog

Link to blog.

This blog is written by Dara Keogh and for more blogs by Dara please go to www.geodirectory.ie/blog

Credits

The graphs and tables used in this blog are taken from the Eurobarometer 487a report link to full report

https://cnpd.public.lu/dam-assets/fr/actualites/international/2019/ebs487a-GDPR-sum-en.pdf

.

Posted: 06/08/2019 10:34:16